10 of The Best Afterpay Alternatives for Shopify Store Owners

Have you ever wanted to buy something but checked your budget and decided you couldn't afford it? You'd have to save up for it over a few months and hope nothing else ate away at your discretionary spending budget.

You want to buy it now, though, and you're worried that it won't be available if you wait. So what can you do? You could put it on a credit card, but the interest on those payments can be killer, and besides, you want to save that for emergencies. You're just out of luck.

This issue is a problem that Afterpay has solved. Afterpay is a service that retailers can use on their Shopify stores. It allows any shopper to sign up for an installment plan for any product the store owner has set it up for. If approved, the customer can sign up and get the product on an installment plan of four months at 25% of the original payment price. Zero interest, zero fees unless the payments are late, and no delays on shipping make it a great little plugin.

What if you want to avoid using Afterpay, though? As a store owner, you like the idea of an installment plan system, but you want more flexibility or features, or maybe you just don't like Afterpay itself. For whatever reason, you want to find an alternative. Are there any?

In no particular order, here's a list.

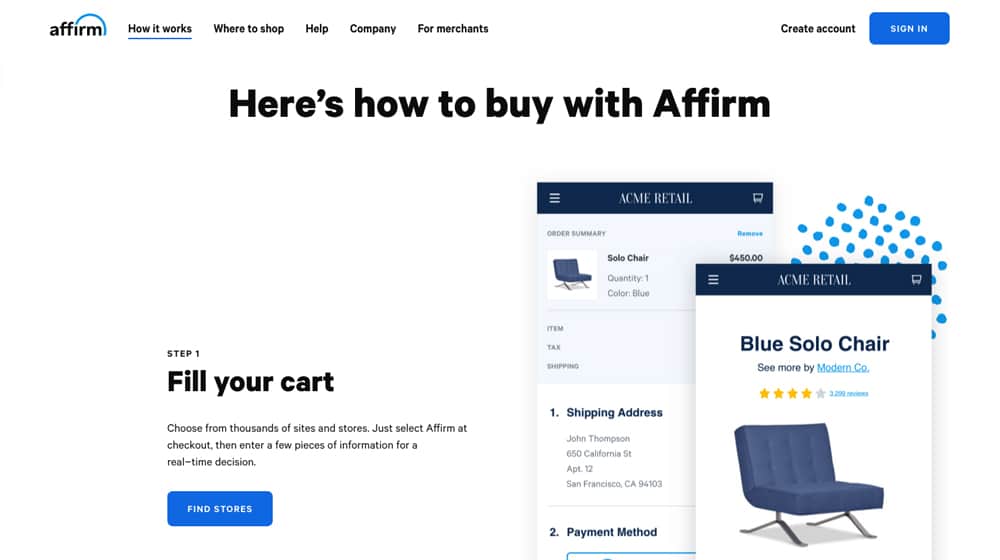

1. Affirm

Affirm is the most prominent Afterpay alternative on the market. If you're looking for a large and trusted company, Affirm is an easy second choice. You've probably heard of it already.

It has some of the broadest customer recognition, and they work with businesses of all sizes. Like other systems, customers add items to a cart, choose how to split up payments – three, six, twelve months, and so on up to 36 months – and apply. Yes, customers need to go through an application process, but it's an almost-instantaneous process (like most other systems).

Affirm pays the total value upfront, minus their fee. Their variable fee depends on the cart amount and their projected risk. They analyze your business, your industry, your risk profile, and your industry's repayment data to determine how much to charge you. They also have special deals for companies that sell more than five million dollars annually.

As always, their system integrates nicely with Shopify via a plugin, and you get a listing on their website's list of merchants, which can be beneficial. You also get the ability to run 0% APR promotions on your buy now, "pay later" sales, which can entice some customers to buy when they wouldn't otherwise.

2. QuadPay

QuadPay is usually a customer-focused payment app. Customers can sign up for the app's service, register their financial data, and get approval to use their payment plan system. Then, when the customer decides to buy something, they pay 1/4th of the purchase price upfront. QuadPay pays the merchant the total value and collects from the customer over the following three months, getting the rest of the payment to restore their coffers.

Customers can also browse through the QuadPay app on their phones and search through stores that have signed up for their service. Using QuadPay puts you in a relatively small, exclusive group of stores those users can browse through, which can be a competitive advantage.

As a business owner, you can use QuadPay on your storefront. It's a simple integration since they have a Shopify plugin linked in their documentation for setting it up on a Shopify store. QuadPay says when you sign up that you become a "QuadPay Exclusive Merchant," it doesn't mean you can only accept payments through QuadPay; customers can still pay via Google, PayPal, Amazon, or simply with a credit card as usual.

Like credit card processing, QuadPay does charge a fee when they process a payment. Their fee structure changes frequently, and their documentation on this isn't publicly available, but I imagine it's similar to other platforms providing the same service.

One of the primary benefits of QuadPay is that they work both online and in a brick-and-mortar store. When you sign up, you can request a kit to use in-store as part of your point-of-sale system, complete with signage and everything you need to get it up and running. Overall, it's a good alternative.

3. ViaBill

ViaBill is another "buy now, pay later" system with a decent degree of flexibility in their system. It's available in the USA, as well as Denmark and Spain. Like Afterpay and QuadPay, customers can sign up to use the system when they check out. If they're approved, ViaBill pays you the total amount for a product purchased, and you ship it out as usual. ViaBill then handles collecting payments from the customer until the product is paid off. Like Afterpay, ViaBill splits the purchase price into four, charging 25% upfront and 25% each month for three months.

ViaBill does charge the merchant a processing fee to use their service. The standard fee is 2.9% plus 30 cents for the purchase.

One nice thing about ViaBill is that they don't just leave you to figure out the installation. You can; they will provide the necessary information to set it up if you want the setup done in-house. On the other hand, you can have their team manage it for you. You give them the necessary information to access your storefront to add their code, and they'll have it set up within a day or two.

Only a few things make ViaBill unique compared to something like Afterpay or QuadPay, but it's a solid alternative if you want to look into it.

4. Splitit

Splitit is an exciting alternative to Afterpay because it runs off the back of existing credit cards. Customers who choose to use Splitit pay with their existing credit cards, which means they don't need to go through an application process when checking out, which can be a massive roadblock for using one of these services. Splitit claims this results in a 78% higher conversion rate, though your mileage may vary. Splitit also doesn't charge interest, unlike just using a credit card.

Like other systems, Splitit does not charge the customer an additional fee. Pricing for the merchant is flexible, with two different plans you can opt for. One of them is the "Standard" plan which charges you 1.5% plus $1.50 per transaction. On this plan, you get paid as the customer pays, so unlike other Afterpay systems, you don't get the full amount upfront.

If you want the full amount upfront, you can opt for the Funded plan, which has higher fees: 3% plus $1 per transaction. For that plan, you have to have been in business for at least a year, be registered in the US, UK, Canada, or Australia, and you need to process half a million dollars in annual sales.

Probably the biggest benefit of Splitit, though, is that the customer can choose how they want to split up the payments, up to a certain minimum threshold. I'm not entirely sure how flexible it is, but they use examples of three payments all the way up to 24 monthly payments, so there are quite a few options.

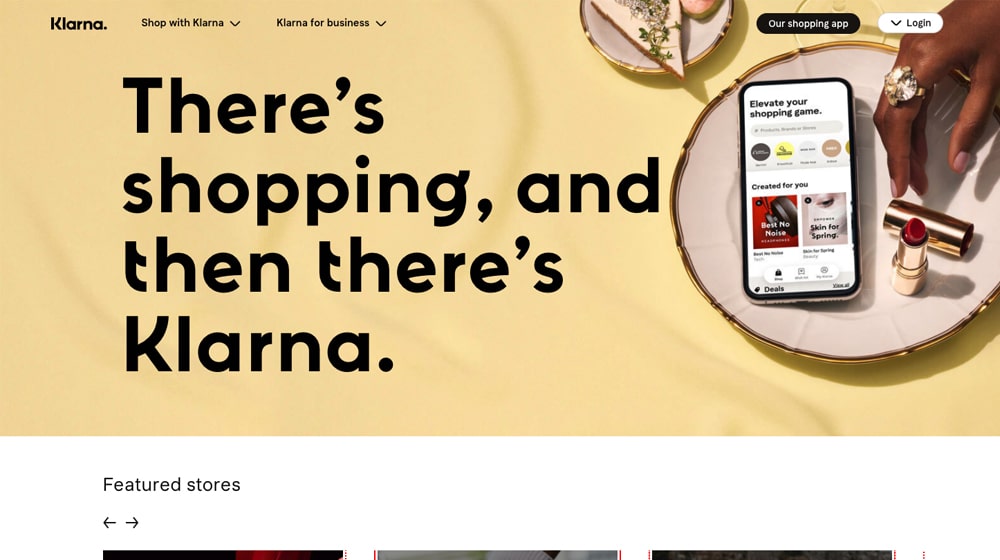

5. Klarna

Klarna is most similar to QuadPay, in that they're focused more on the customer app than on the merchant integration. Customers who use the app can shop through it and browse your products directly. Of course, it's not exclusive, and you can integrate it with your website just the same as the other systems.

Klarna does offer a couple of more unique styles of pay later systems. The first is the standard installment plan, where the customer pays one portion of the payment immediately and then three other portions of 25% each, while the retailer is paid the full amount upfront. That's typical.

The system also offers a "pay in 30 days" system, where the customers can try out your product for 30 days before paying. They do have to actually return any products they don't want if they don't want to pay for them, at least. This can be good but might bring a spike in returns with it, so be prepared.

The third system is flexible financing, splitting payments up to as many as 36 months. The customer chooses how divided they want it to be, though they can't split up small purchases below a certain monthly payment.

Like QuadPay, Klarna also has the in-store option that gives you the stuff you need to use it in-store, along with marketing material to let customers know it's available.

As for fees, pricing varies based on the customer's country of origin. Since most of my readers are US-based, pricing for the US is:

- 30 cents plus a variable fee of up to 6% for the 4 installments plan.

- 30 cents plus a variable fee of up to 3.3% for the financing option.

- 30 cents plus a variable fee of up to 6% for the "pay in 30 days" option.

- 30 cents plus a variable fee of up to 3.3% for the full checkout solution.

- 30 cents plus a variable fee of up to 3.3% for the in-store option.

All in all, it's pretty simple and reasonable. It's one of the better, more flexible Afterpay alternatives, and can be well worth looking into.

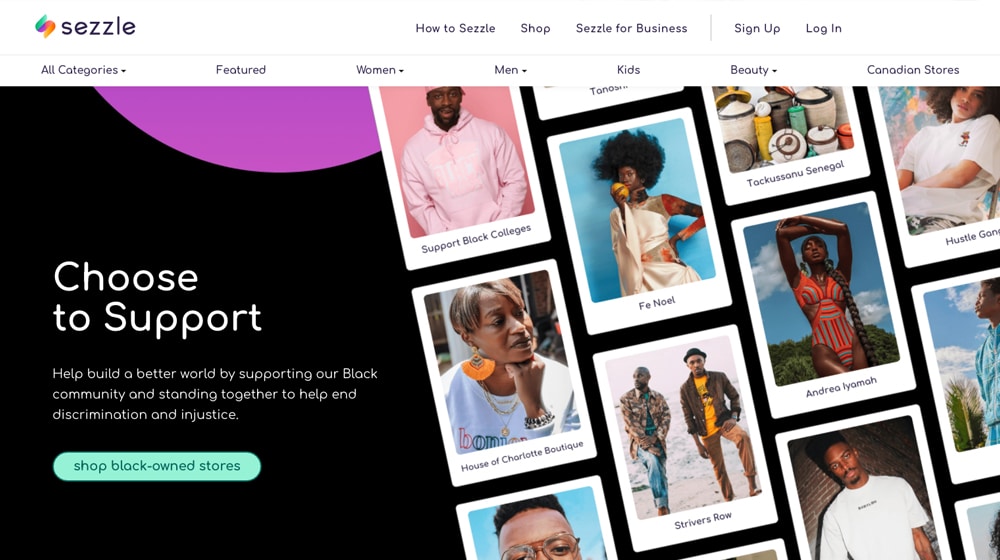

6. Sezzle

Sezzle bills itself as the highest-rated buy now, pay later solution, as ranked by shoppers. I'm not sure what survey they used or where they got their data, but sure, let's go with it. What do they have that stands up to the competition I've already listed?

First of all, rather than a flexible division or a monthly payment plan, they split payments up into four and have the customer pay every two weeks, with the initial payment, of course. They work with Shopify, but they do not have an in-store option. They can work just about anywhere in the world, so long as the customer has a traditional credit or debit card to pay with.

Much like Klarna, the rates you're charged for Sezzle will vary depending on your business's location, size, and industry. You'll have to contact their sales team for an appraisal. Like most of these companies, rates are usually determined by your sales volume and by your risk assessment.

Overall, Sezzle doesn't do anything unique compared to the alternatives; they just do it well. They're among the largest Afterpay alternatives out there, so they definitely work. If you want more flexibility, go with one of the others. If bi-weekly payments are fine for your customers, Sezzle should work perfectly.

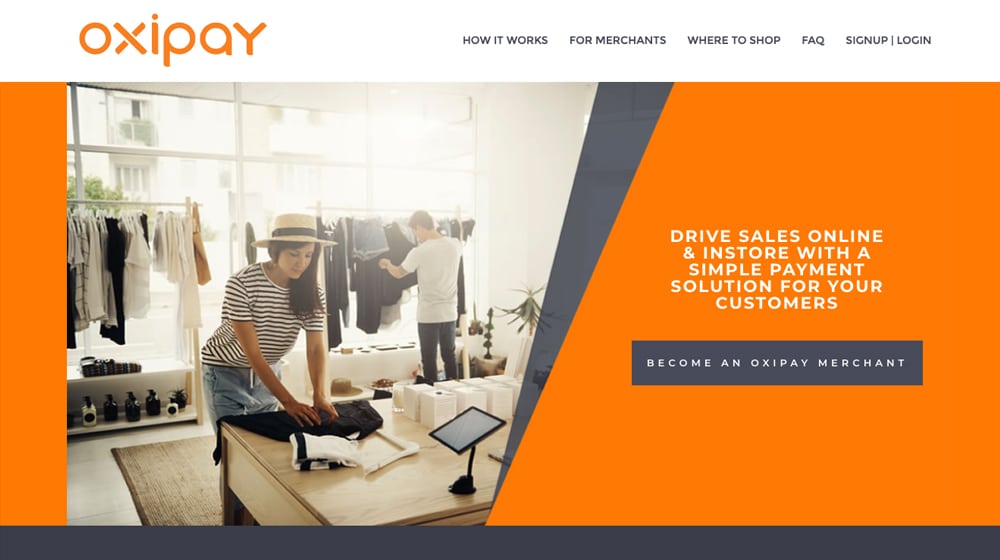

7. Q Mastercard, Formerly Oxipay and Humm (New Zealand Only)

Oxipay was similar to many of the above apps, in that it was a customer-focused portal with the option to sign up as a merchant, for similar benefits: promotion on their website, access through their system, and so on.

Unlike other Afterpay-style platforms, Oxipay wasn't a monthly payment plan. Rather, it split the payment into one of two options, of the customer's choice. One was four payments, one every two weeks. The other was eight payments, once a week. This offered more flexibility to some users, but didn't work for others. Before you choose a solution like this, make sure you determine if your user base would prefer monthly or weekly payments overall.

Customers had to sign up for the service, which required a New Zealand mobile number and NZ-issued credit or debit card, plus an NZ shipping address. It was kind of restrictive, honestly, which is the reason it's so far down on this list.

8. PayPal Credit

PayPal isn't technically the same kind of Afterpay system, but I thought I'd list it since it's an option you can use. When you use PayPal as a payment method, customers have the option for larger purchases to sign up for PayPal Credit when they check out.

Unlike other Afterpay-style systems, PayPal Credit is really just a credit card system, backed by PayPal rather than a bank. It has all of the usual roadblocks a credit card has, including the more detailed credit check to get approval, and there's some general distrust of PayPal as a company so not everyone likes this idea. Still, it's an option, if you want to use PayPal as a payment processor.

Their official plugin has some poor ratings on the Shopify App store, so you may want to do some research into that before you install it. Despite how recognizable PayPal's brand name is, they are not very friendly to businesses, and their app could break your website or throw errors. If you can get it working and your business requires PayPal, you could always try out the plugin (it's free), but ideally, credit card processing paired with one of the above financing solutions is going to be much more reliable and stable.

9. Shop Pay

Emerging as a formidable contender in the buy now, pay later service sector, Shop Pay from e-commerce giant Shopify offers an intuitive and streamlined experience for both customers and store owners. Its distinguishing feature is the seamless integration with Shopify, positioning it as an ideal, reliable, and straightforward payment option for Shopify merchants.

Shop Pay's structure allows customers to break down their purchases into four equal, zero-interest payments. The first payment is made at the time of purchase, with the remaining three billed bi-weekly. This approach opens up the potential customer base for businesses, making shopping more affordable and encouraging more conversions due to its user-friendly nature, high acceptance rates, and simplified application process.

One key advantage for merchants is Shop Pay's provision of immediate payouts. Despite customers paying in installments, merchants receive the full payment upfront, guaranteeing immediate liquidity. Additionally, Shop Pay's transparent fee structure, with rates standing at 1.5% plus 15 cents per transaction in the U.S., aids in cost prediction and offers excellent value due to its competitive nature.

Safety and sustainability also rank high in Shop Pay's offerings. The platform employs machine learning for robust fraud prevention, ensuring secure transactions. Moreover, with every purchase made via Shop Pay, contributions are made towards tree planting, enhancing sustainability, and promoting the eco-conscious image of your brand.

Powered by a partnership with Affirm and launched in June 2021, Shop Pay has showcased its effectiveness as a merchant tool. During the early access phase, one in four merchants using Shop Pay Installments witnessed a 50% increase in average order value compared to other payment methods and a decrease in cart abandonment by 28%.

With its reliability, ease of use, and superior customer experience, Shop Pay stands as a compelling installment payment solution for Shopify merchants to consider.

10. Add a Custom "Pay Later" Service as a Payment Method

GrabPay, also known as PayLater by Grab, is an officially supported payment method on Shopify, and they have a BNPL (Buy Now Pay Later) option. You can install the Grab app and enable it as a payment option on your store by visiting the installation option above.

After enabling a payment method that supports BNPL, you'll want to display it on your product pages so that customers know they have an option. You can use an app like Scala Installments to accomplish that functionality, which is compatible with GrabPay and will display the option and the logo on your product pages. It's easy to set up and has excellent ratings on the Shopify App store.

It will work with other third-party payment processors as well, including:

- Klarna

- Mercado Pago Parcelamento

- GrabPay

- Atome

- PayPal

Scala Installments was added to the app store in the past year, so it's still pretty new, but I like its flexibility. You can easily switch to a different payment method if you change providers, and Scala Installments will help you swap the logo out on the front end. Easy!

So there you have it; a bunch of different Afterpay alternatives, all of which are available on Shopify. There should be something for just about everyone here, but feel free to let me know in the comments if I've missed your favorite!

August 18, 2020

Here in the Middle East, we use Tabby for this option. It's pretty much the same as Afterpay. Before deciding on using any of these options, make sure you read about their different charges.

August 18, 2020

Thanks for sharing! Good to know for users in the Middle East.

September 20, 2020

What about Zip? They're a big player next to Afterpay.

September 21, 2020

Hey Claire! This looks like a good alternative for businesses in Australia and New Zealand, but it looks like it's limited to those two countries at that time. Thanks for sharing!

November 02, 2020

Hey James! Have you tried Four? Just run through their site and seems pretty good.

November 09, 2020

Hi Ellen! By "Four" do you mean the 4th on the list, Affirm?

If so, I think Affirm is arguably the biggest alternative to Afterpay. I have a couple of clients that use them with great success. In terms of popularity I think it's a close 2nd to Afterpay.

July 06, 2021

Hey James. I read another article that mentioned GoCardless, it's one of the most rated alternatives to afterpay. Can it also be used for Shopify?

July 08, 2021

Hi Mary!

Funny you mention that; I was on their site not too long ago.

They don't support Shopify natively, but there are third-party APIs like at Clarity Ventures.

This is a pretty intense setup for larger businesses selling higher ticket items (think five figures for each product). Their API is $995/mo.

There are probably better options available for your business unless this sounds like it would be a good fit for your product line.

August 08, 2021

We just started using Viabill. The fees are relatively small compared to others

August 12, 2021

Hey Michael, thanks for sharing!

Have you tried Afterpay or any of the others? Is price the primary reason you decided on Viabill?