Does Afterpay Increase Your Shopify Conversion Rate and Sales?

Business goes in cycles. Some things trend, then fade out of style, and trend again later. One such trend is the idea of buying something now and paying for it later.

You see this concept all the time, though the reputation it has may vary.

- Buying something on credit means paying for it now with money you're lent and have to pay back, often at a relatively high interest rate. Some people are responsible and pay this down quickly, while others carry the rolling debt for years.

- Layaway is a plan some retailers use, where you go to a store and have a product set aside, making payments on it until you're done paying for it, at which time you're given the product. Sometimes a service fee, cancellation fee, or restocking fee is attached.

- Installment plans are similar; you buy an item on the promise of making regular payments towards it. It's basically the same as a loan like you'd get for a car, but smaller and focused on smaller products.

Afterpay is a relative newcomer to the scene, a business that has popped up with a service it offers to retailers.

What is Afterpay, and How Does it Work?

Afterpay is a particular Australian (but globally available) company offering a "buy now, pay later" product. They are one of many companies in the niche, including others like Affirm, Clearpay, and Klarna.

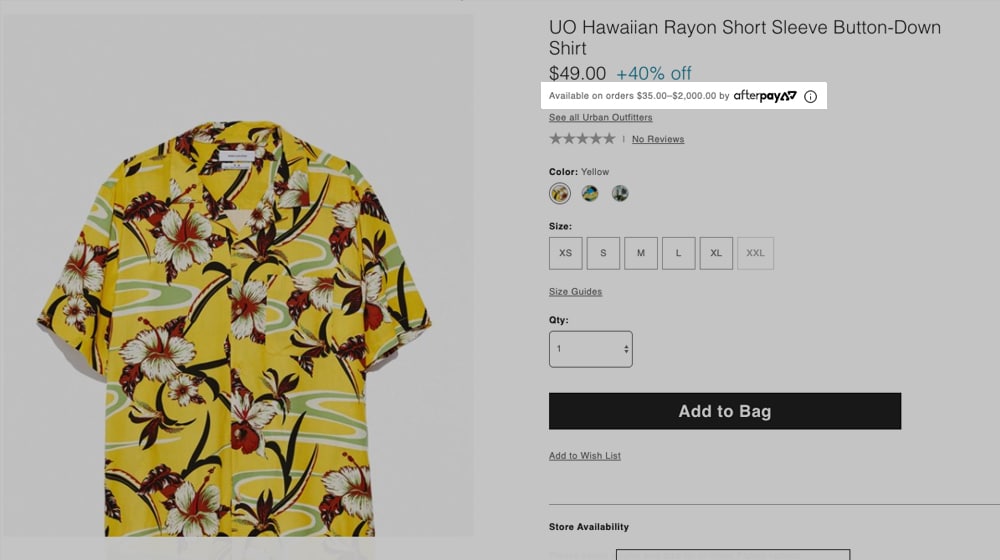

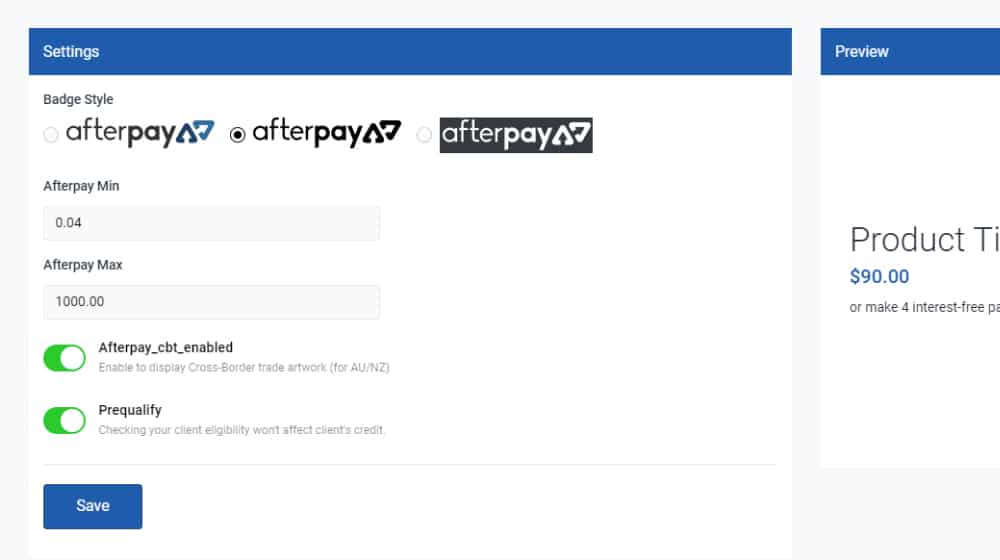

As a retailer, Afterpay is easy to use. You sign up for their service and implement it as an option on your site. Once you set it up, an option for Afterpay appears on your product pages and in your shopping cart. You can see this in action on Urban Outfitters's website since they're one of the high-profile customers using the service.

When a user is browsing products on your site, they will see the Afterpay message. They can click the little (i) for more information, and it will explain to them how it works.

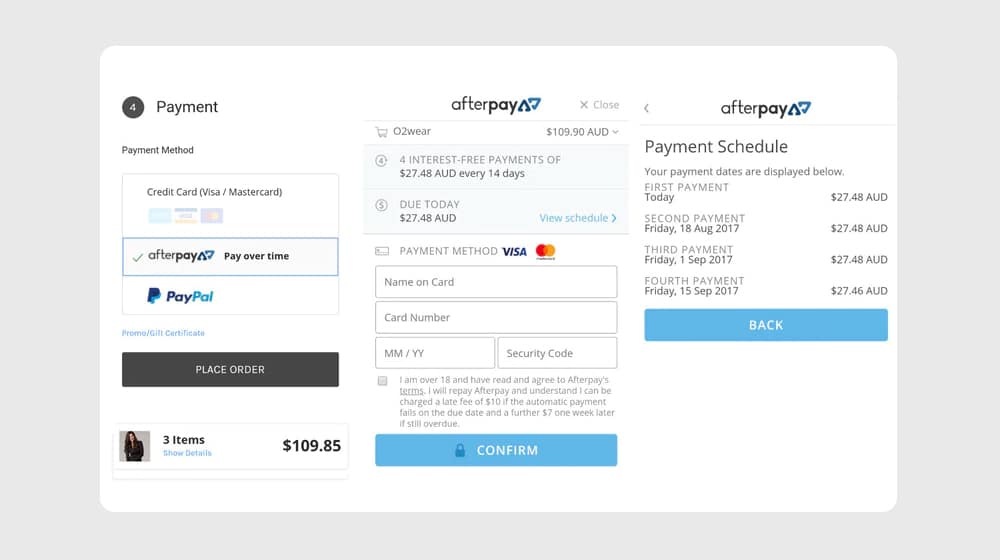

The user can sign up for Afterpay, filling out a short form that asks for some basic information to verify the eligibility of the user. If the user is approved – which is an instant decision – they can opt for the Afterpay installment plan.

Afterpay offers the ability to pay in a handful of reasonably-priced payments, rather than all at once. Specifically, the cart price is divided into four equal payments, spaced two weeks apart. This is aimed to align with the average time that most Americans are receiving their bi-weekly paychecks. This means it can be effective for large orders but is less valuable for smaller shopping carts.

From the retailer end, when a user signs up and is approved for Afterpay, and they complete the checkout process, everything on your end looks like a normal conversion save the payment. You are paid immediately by Afterpay themselves. They are the ones who take on the responsibility of collecting ongoing payments from customers and pursuing those who do not pay up on time.

You don't earn any extra money from using Afterpay, at least not directly. If Afterpay increases conversion rates, of course, you'll benefit from that. Conversely, Afterpay doesn't make money from your sales. They don't increase the price of your products for people using the service, which would make it less attractive. A user can pay $80 for your product now, or 4x payments of $20 each over the course of two months; it makes no difference.

Afterpay needs to make money, though. How do they stay afloat? Well, they make money in two ways. The first is similar to any loan; late fees. If a user signs up and fails to pay on time, late fees can be incurred. The user can pay them and get back in the good graces of Afterpay, or if they go delinquent, Afterpay can pursue civil damages and get their money.

The other way Afterpay makes money is by charging you, the retailer. Afterpay actually takes a small commission out of the purchase price. This commission varies based on the size of the order and the volume of orders you process through their platform. This is a flat 30 cents per transaction, plus 4-6% of the value of the transaction. So your $80 sale means you're paying Afterpay somewhere between $3.50 and $5.10.

How Does Afterpay Encourage Conversions?

Installing Afterpay means an immediate effect of, for every sale it processes, losing a bit of money. So why is it so heavily recommended, and why do businesses claim it boosts their sales and profits?

Afterpay encourages two things out of your users. The first is that, since they can buy immediately and pay over time, they're encouraged to make purchases that they wouldn't normally make. Retail worker Dave might not have $80 in extra cash to spend on a nice pair of pants he really wants, but when he can spend two months paying $20 every paycheck, it's a much more reasonable purchase to make.

Among some of the particularly savvy underemployed, the ability to buy a higher quality (and thus more expensive) product for a reasonable price over time might encourage them as well. If Dave has the choice between one $20 pair of pants and one $80 pair of pants, well, he has a choice to make. If the $20 pair of pants is going to last a month before it wears out or tears, he has to buy a new pair of pants every month. If the $80 pair of pants will last him two years, it's a better value over time.

Think about the Sam Vimes "Boots" theory of economic injustice.

This is a quote from the famous fantasy author Terry Pratchett:

"The reason that the rich were so rich, Vimes reasoned, was because they managed to spend less money.

Take boots, for example. He earned thirty-eight dollars a month plus allowances. A really good pair of leather boots costs fifty dollars. But an affordable pair of boots, which were sort of OK for a season or two and then leaked like hell when the cardboard gave out, cost about ten dollars. Those were the kind of boots Vimes always bought, and wore until the soles were so thin that he could tell where he was in Ankh-Morpork on a foggy night by the feel of the cobbles.

But the thing was that good boots lasted for years and years. A man who could afford fifty dollars had a pair of boots that'd still be keeping his feet dry in ten years' time, while the poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet."

Some people are legitimately in this situation, and the ability to pay for a higher quality product over time is very attractive to them. Thus, Afterpay can increase your sales amongst people who wouldn't normally be willing or able to spend money on the products you offer.

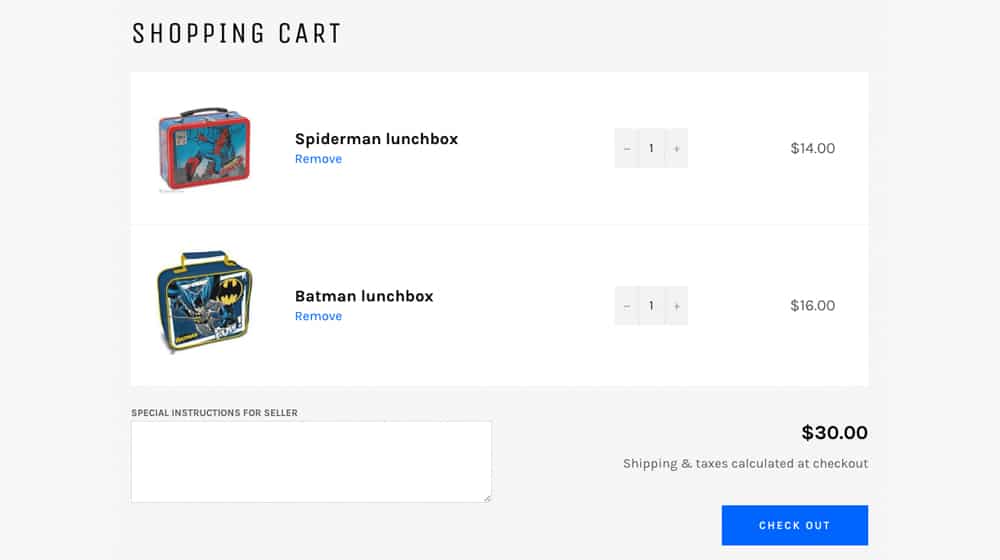

The second way in which Afterpay encourages your bottom line is by increasing the average shopping cart value. See, Afterpay has a minimum order size. In order to qualify for Afterpay, the shopper must have at least $35 worth of product in their cart. This can be one more expensive product or multiple less expensive products.

Remember years ago when Amazon offered free shipping on carts over a certain value? People would add items they only kind of wanted – or even filler items – to boost their cart value to take advantage of the free shipping.

Afterpay works the same way. If they want a $30 product, but don't have $30 immediately, they can add $10 worth of items to their cart. Now, suddenly, they're paying $10 every two weeks, which is both more affordable to them and a higher cart value for you.

Combining these two effects means you're getting more conversions from people you normally wouldn't be able to sell products to, and you're getting higher value shopping carts out of people who are interested in using the pay-over-time service. It's two wins, zero losses.

It's worth mentioning that these aren't just made-up theories. Multiple case studies in Australia and beyond have shown that both effects are very real, though the exact percentage increase you get in conversions and conversion value will vary.

The Pros of Using Afterpay

Let's talk about the various pros and cons of using Afterpay, specifically.

Pro: As mentioned above, you can get higher conversions and higher conversion value. This is not guaranteed (and I'll discuss that down below in the cons section), but when it works, it can be very effective. And really, who doesn't want to have higher conversion rates and higher conversion values for their store? If all you need to do is add an optional payment method to your site to get that, it's basically a no-brainer.

Pro: Afterpay is completely optional; users are not required to use it, so it doesn't affect those who aren't interested. The people who don't want to use it do not have to use it, and indeed might not even notice it's an option when they go to check out using something like a saved credit card, Amazon Pay, or PayPal.

Pro: Afterpay only costs you money on successful sales using it, so you're not losing money if people aren't using it. There's no ongoing monthly fee, no setup fee, no account fees, nothing like that. If you install Afterpay and no one uses it, then you can just uninstall it, and the only thing you'll have lost is your time.

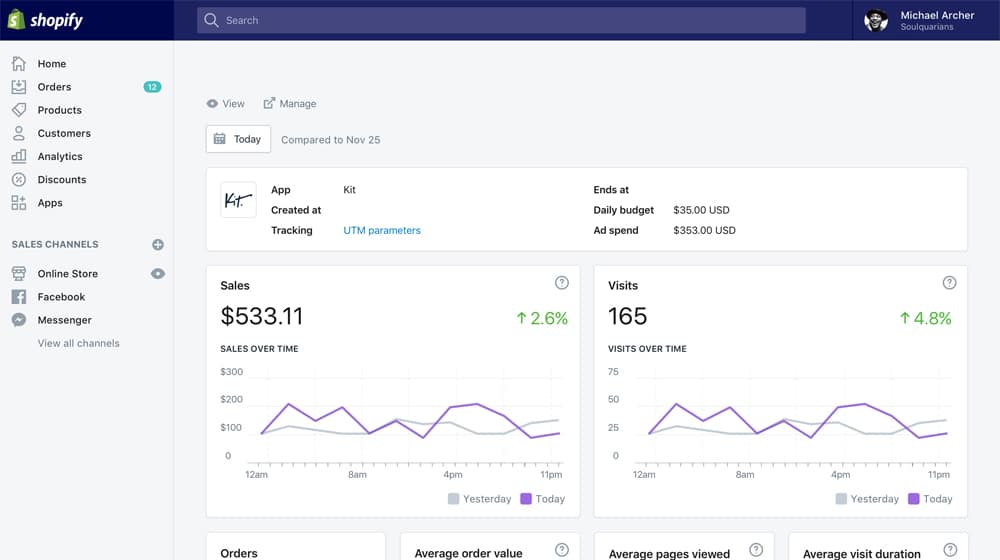

Pro: Afterpay plays nice with a number of different e-commerce platforms, including Shopify, Magento, WooCommerce, and more. In Shopify specifically, it's very easy to install. Register for Afterpay. Once you have an account, go to Shopify and go to settings. Under Payment Providers, there will be an Alternative Payments section. Find Afterpay in the drop-down. Choose it and you'll be asked to add your Merchant ID and Merchant Key from Afterpay. Once that is added and verified, you can add the Afterpay code to your store's theme (this post has instructions on how). Alternatively, you can use the unofficial app installer here.

Pro: Like many pay-on-credit options, the risk is entirely out of your hands. You're paid regardless of whether the shopper stops paying a month down the road. This gives you (the business owner) some peace of mind, as some people sign up to make payments on something they can't actually afford and end up missing or being late on their payments.

Now let's talk about the cons of using Afterpay.

The Cons of Using Afterpay

Con: Afterpay doesn't always pay you immediately for your sales. According to their own support documentation and the word of other people who have used the platform, payments can sometimes take as long as 48 hours to come in. If you're used to having access to your funds more or less immediately so you can reinvest your profits, the delay can throw things off.

Con: The people most likely to use Afterpay might not be in your target market. This means that you can actually lose money. Wait, what?

Using the $80 sale example up above, let's say all of the people who buy items from your store are buying the same $80 item. If they all decide to use Afterpay, instead of getting $80 per sale, you're getting $75 per sale, or whatever the commission works out to be.

Normally, this is offset by the two factors above; more conversions and higher value. However, if neither of those two conditions happen, you lose more in fees than you make from adding Afterpay as an option. You end up actually losing some of your profits or, if your profit margin is slim enough, losing money overall.

If you're getting a 25% increase in revenue but you're losing $5 on every sale, you'd most likely take that as a win. It depends on how many of your customers end up using Afterpay, and how much of a presence it has on your store and marketing materials.

Con: Afterpay's commission is a little steep, even compared to some of its competitors. Even that comparison I linked is a company providing the same service for roughly half the price. You still pay on commission and you still run into all the pros and cons of Afterpay, just with a different company and a lower price point. Other companies offering the service are in a similar boat. Some may be more expensive or use a different payment model, but some are less expensive and operate the same way.

Con: Afterpay has an upper limit of $1,000 per transaction. This means if you're used to very high-value purchases, it doesn't work. Granted, this is only applicable to high-end luxury brands and companies selling products that cost over a grand each. I don't know how many of you are even reading my blog, to be honest. But hey, if you are, drop me a line, let's talk blogging, eh?

Con: Some people feel that buy-now-pay-later services like Afterpay encourage bad financial habits and should be regulated. The percentage of the population is small, but there ARE some people who will choose not to shop at your store because you're facilitating poor financial decisions among others, or even just because they've had bad experiences in the past. I doubt this will be meaningful enough to matter, but it's possible.

Con: Afterpay could slow down your site. Any time you add an additional customer-facing plugin to a site, it slows it down. Afterpay is generally very lightweight, though, so the slowdown shouldn't be meaningful. It's still a factor, though, especially if you have a lot of customers using slow or mobile internet.

Is Afterpay a Good Choice for Your Business?

After reading all of the above, what do you think? Is Afterpay a good choice for your business? Here's my analysis.

Afterpay is good if you fit three criteria. First, you need to be selling items that are higher priced. You want to be in the sweet spot between "too low a cart value to be worth adding products to qualify" and "too high such that the average buyer doesn't need to distribute payments." If most people you sell to don't need a pay-over-time solution, offering one won't do much.

Second, you need your target audience to be full of people who would buy but can't normally afford to. This can be tricky because a huge part of marketing revolves around optimizing your ads to reach the people most likely to buy. You may need to broaden your ad campaigns specifically to target people willing to use Afterpay.

Third, you need have a low enough "Average Cart Value" that you don't overshoot the Afterpay cap. If your customers are checking out with over $2,000 in merchandise in their shopping carts regularly, then your customers aren't going to be able to use Afterpay at all.

So let me know in the comments. Have you used Afterpay? If so, how did it go? Alternatively, have I convinced you to give it a try? If so, give me an update after a few months. Keep in touch!

May 14, 2020

Hi James, how do I know how much of a cut Afterpay will take per sale? Have you found the amount of sales you recive is worth the cut in profit per sale?

May 15, 2020

Hey Mark!

Afterpay takes anywhere from 4% to around ~6% per transaction. The amount of product you sell through Afterpay will change the amount that they charge, so if you're moving thousands of products per month through them (especially higher dollar products), they drop their pay cut over time to give you better rates.

This is similar with credit card processing, if you are bringing a large volume of sales to the table, you generally have more bargaining power.

As for your second question, absolutely - I think it works better with higher-priced items that people want to enjoy today, so if you're selling products for $10-20 each, people are less likely to type in their social and have a credit check performed for something small like that. You can still get sales like this, but it is most effective on expensive items, in my opinion.

We have a handful of clients who use Afterpay on their Shopify sites and they get a surprising amount of sales with it, if you have something for sale for $899, and under it, it says something like "Or in 12 monthly payments of $74", a good chunk of people will choose to pay it off over time instead.

It's worth giving it a try, especally if you have an established store with sales and higher-priced items. For me, the biggest benefit is that they absorb all of the risk incase somebody defaults on their payment. You get paid no matter what.

August 16, 2020

Thanks for this. I am actually looking into using Afterpay however I have this thought that it might not work and thinking I would end up paying more than what I’ll earn. Do you think they can allow a 1-2% commission instead to 4-6%?

August 17, 2020

Hi Mitch! The percentage fluctuates depending on the dollar amount of the items you're selling, but no you're not going to find a percentage that low. Keep in mind this company is processing credit applications and taking on a certain amount of risk, while guaranteeing your payment even if the buyer defaults on their payment. That should be well worth that 4-6%.

We wrote another post on Afterpay alternatives that you might be interested in:

https://www.contentpowered.com/blog/afterpay-alternative-shopify-store/

August 18, 2020

Hi James! Great information you provided...I have a dropship store currently and I was wondering if Afterpay would be an option for me...I tried Klarna and was told that because I don’t ship all my merchandise from the US, their services couldn’t be offered to me at this time....thoughts?

August 18, 2020

Hi Kelley!

We wrote a whole post about the various Afterpay alternatives, if you want to see the complete list:

https://www.contentpowered.com/blog/afterpay-alternative-shopify-store/

Afterpay works great for US-based businesses, we have a number of different clients who use them and are thrilled with it.

It's probably the only service you'd need, but if you're not a fan, check out those alternatives 🙂

March 02, 2021

Will Afterpay work for a massage Clinic. Our prices start at $35 right through to $315. And how do you link Afterpay with the terminal you are using. For instance if we have a sale of $90, the client has an account with them, I have an account with them, what process allows the full amount to be paid to me and the client to process installments. I use square. How is it all linked up.

I hope this makes sense to you.

March 04, 2021

Hi Kate!

Afterpay does have an "In-Store" feature for their brick-and-mortar customers, but I believe it is limited to companies that sell tangible goods.

I'm not certain that they can facilitate financing for services or intangible goods.

It can never hurt to apply or reach out to them and see if they can help you.

I would think a subscription model would work well for your industry - many massage clinics have gone this route, including large nationwide chains like Massage Envy.

June 24, 2021

What happens if someone wants to return their item? Do I refund the customer, or Afterpay?

June 25, 2021

Hey James! You would refund the full payment to Afterpay, and they'll repay any payments made to Afterpay back to the customer.

September 28, 2021

I'm using Afterpay but the cut they take is ridiculous. Their percentage is quite high

September 28, 2021

Hi Joseph!

Thanks for sharing. I suppose that's their cost of dealing with payment defaults and chasing customers with collection agents.

You get paid up-front, and they take all the risk.

They are the big player in the space, and I'm sure there will be more alternatives coming out every year who are chomping on their heels!

Please let me know if you switch. I'd be curious to hear who you decided to settle with in the end.